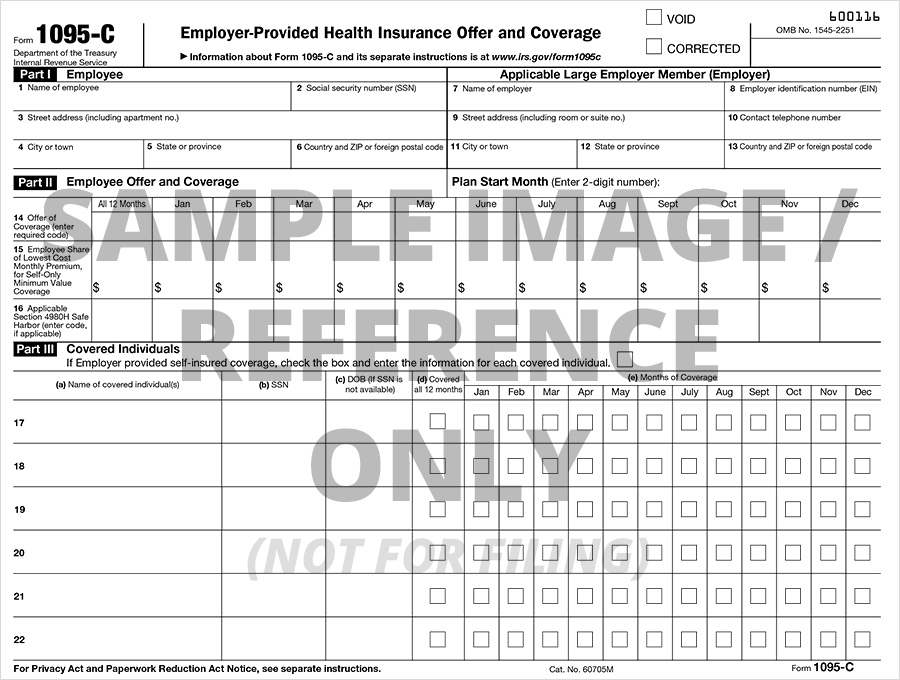

Employers may become overwhelmed by health insurance paperwork and reporting responsibilities. Under the Affordable Care Act (ACA), the IRS requires all applicable employers and qualified health plan providers to report information about their health plans and health coverage enrollment using tax Forms 1095 A, B, and C. However, there are different requirements for each of these documents.

Which ACA Form 1095 Applies to My Business? 1095-B VS. 1095-C

Entering Form 1095-A, 1095-B or 1095-C health coverage in ProSeries

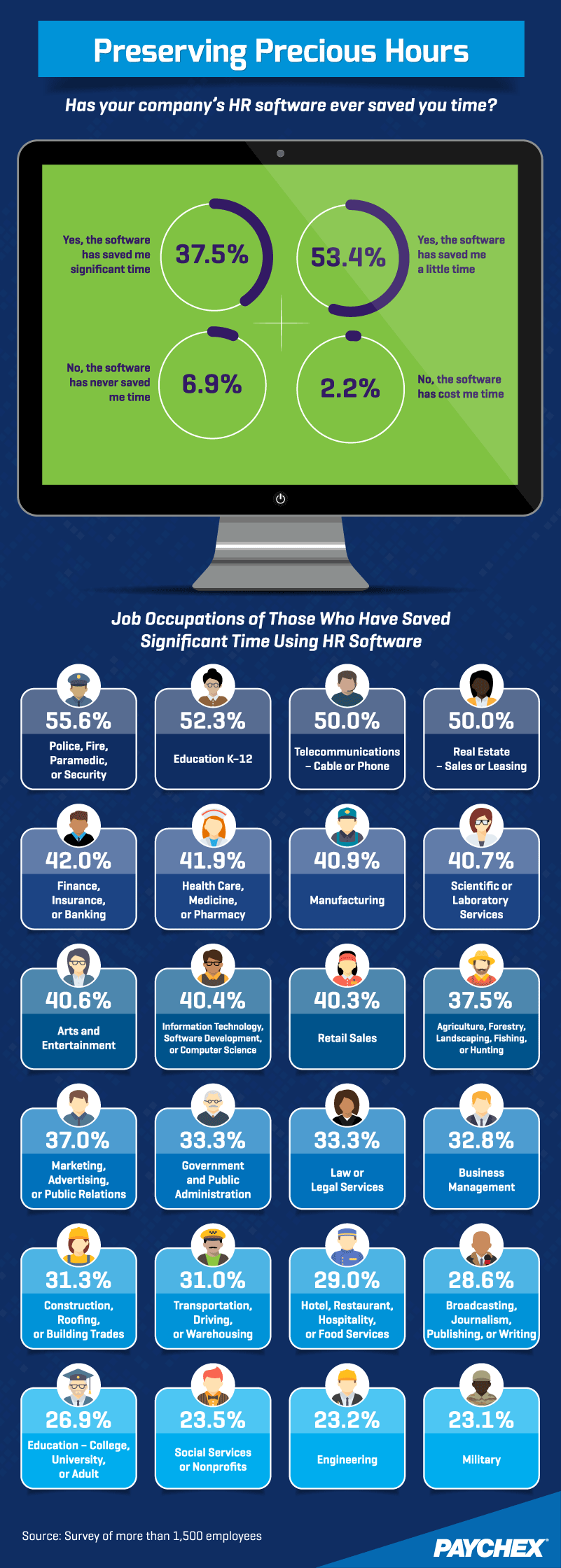

There's an App for That: HR Goes High-Tech

How to Do Payroll Yourself: The Ultimate Guide

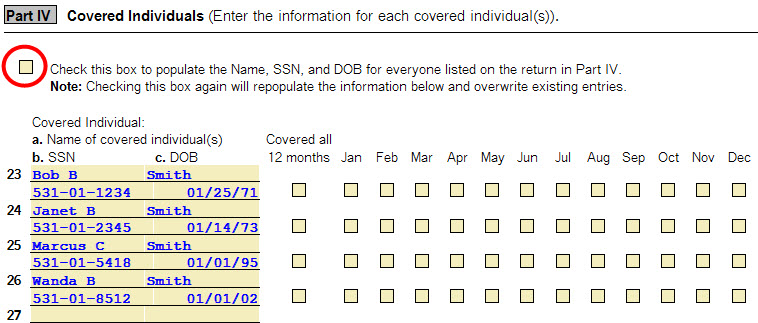

Form 1095-C Instructions - Office of the Comptroller

1095-A Tax Form

Tax Reform: How Has It Changed, and What It Means for you

What To Do With New ObamaCare Forms 1095-B, 1095-C For 2016 Tax Filing Season

TaxBandits' Guide to Finalized Forms 1095-B and 1095-C for Tax Year 2023

Preventing Workplace Harassment: 5 Proactive Steps

What CPAs need to know about new PPACA forms

A Guide to Forms 1095 & 1098 and Nonresident Tax Returns

ACA Supported Forms - Aatrix

)