Section 2(11) of Income Tax defines 'Block of Assets' as a 'group of assets' in respect of which the same percentage of depreciation is to be applied

Detailed Guide on Capital Gains Taxation, Section 45 to Section 55A

What Does a Financial Advisor Do? Definition and Examples

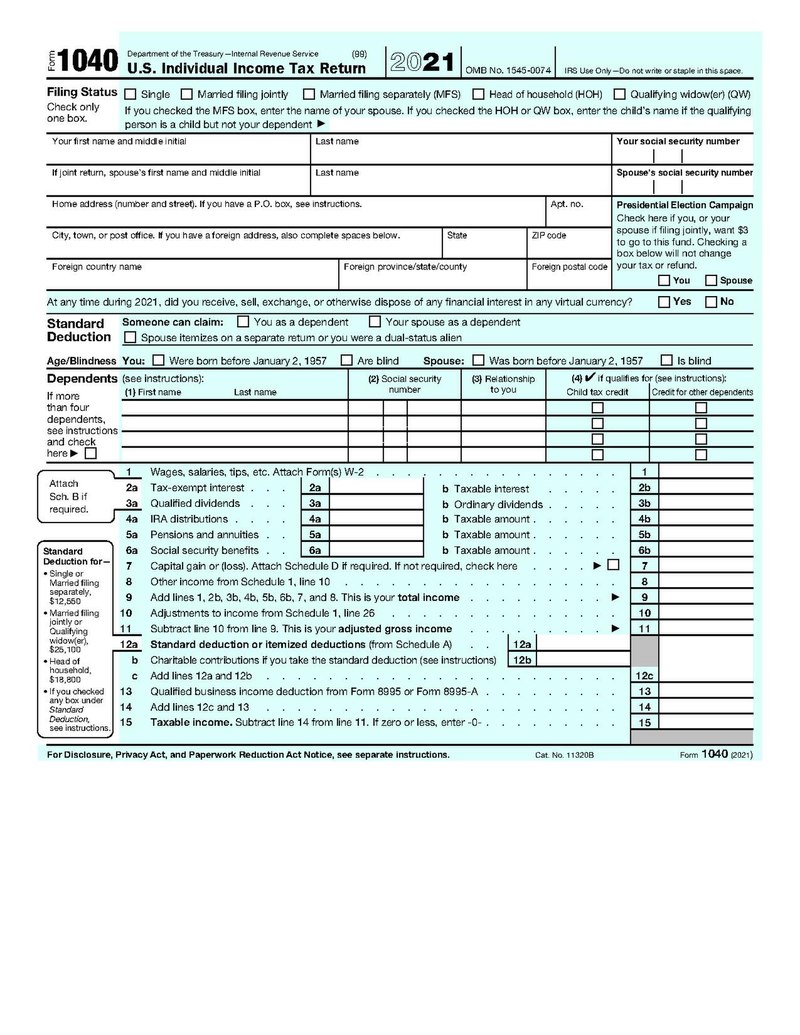

Form 1040 - Wikipedia

What Is a Section 121 Exclusion? Definition, Example and Basics

Why do we have a concept like block of assets for charging depreciation in the income tax act of 1961? What were the lawmakers thinking? - Quora

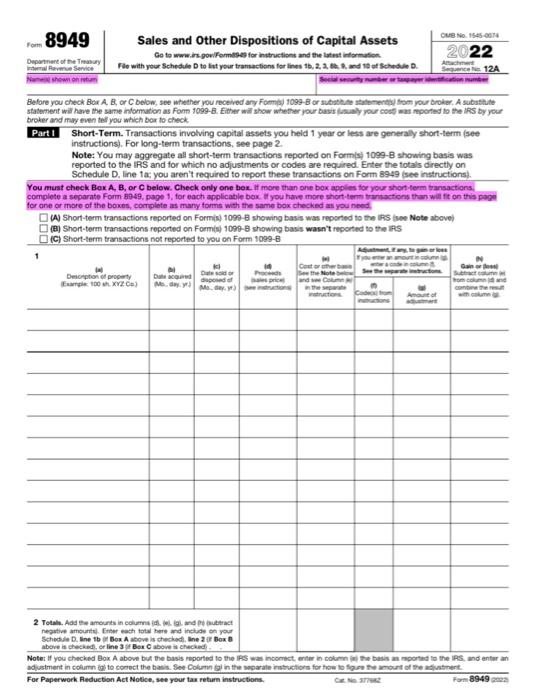

You will be preparing a 2022 personal income tax

Section 2(11) Income Tax: Block of Assets - Meaning & Concept

Concept of Block of Assets and Depreciation Rates - Depreciation Compu

Annual State of the City's Economy and Finances : Office of the New York City Comptroller Brad Lander

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax-Exempt Income?