A Single Bench of the Madras High Court has recently held that gift vouchers and gift cards are actionable claims and Goods and Services Tax

LiveLaw on LinkedIn: Madras High Court Reserves Order On Suo Motu Revision Against Minister…

Vouchers- Concept & GST implications thereon with Practical Case Studies

133 GST Judgments, PDF, Forgery

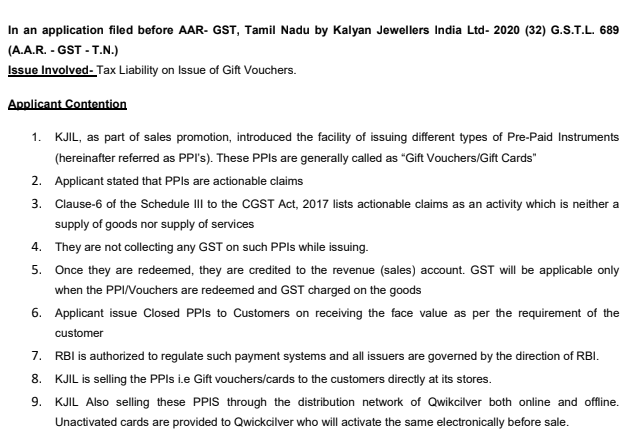

Tax Liability on Issue of Gift Vouchers.

Advance Ruling Applications, Taxscan

An Overview of the Goods and Services Tax (GST) Regime in India: Key Features, Benefits and Commodities Excluded, PDF, Value Added Tax

Taxscan on LinkedIn: Depreciation Allowable on Goodwill u/s 32(1

Handbook On GST On Service Sector, PDF, Value Added Tax

No GST Applicable On Supply Of Vouchers: Karnataka High Court

CA Anupam Sharma on X: *Madras High Court Clarifies GST Levy on Gift Vouchers as 'Actionable Claims' not Subject to Schedule III* The Madras High Court has offered clarity regarding the levy

Experts Internal Page

Understanding the Supply of Goods and Services

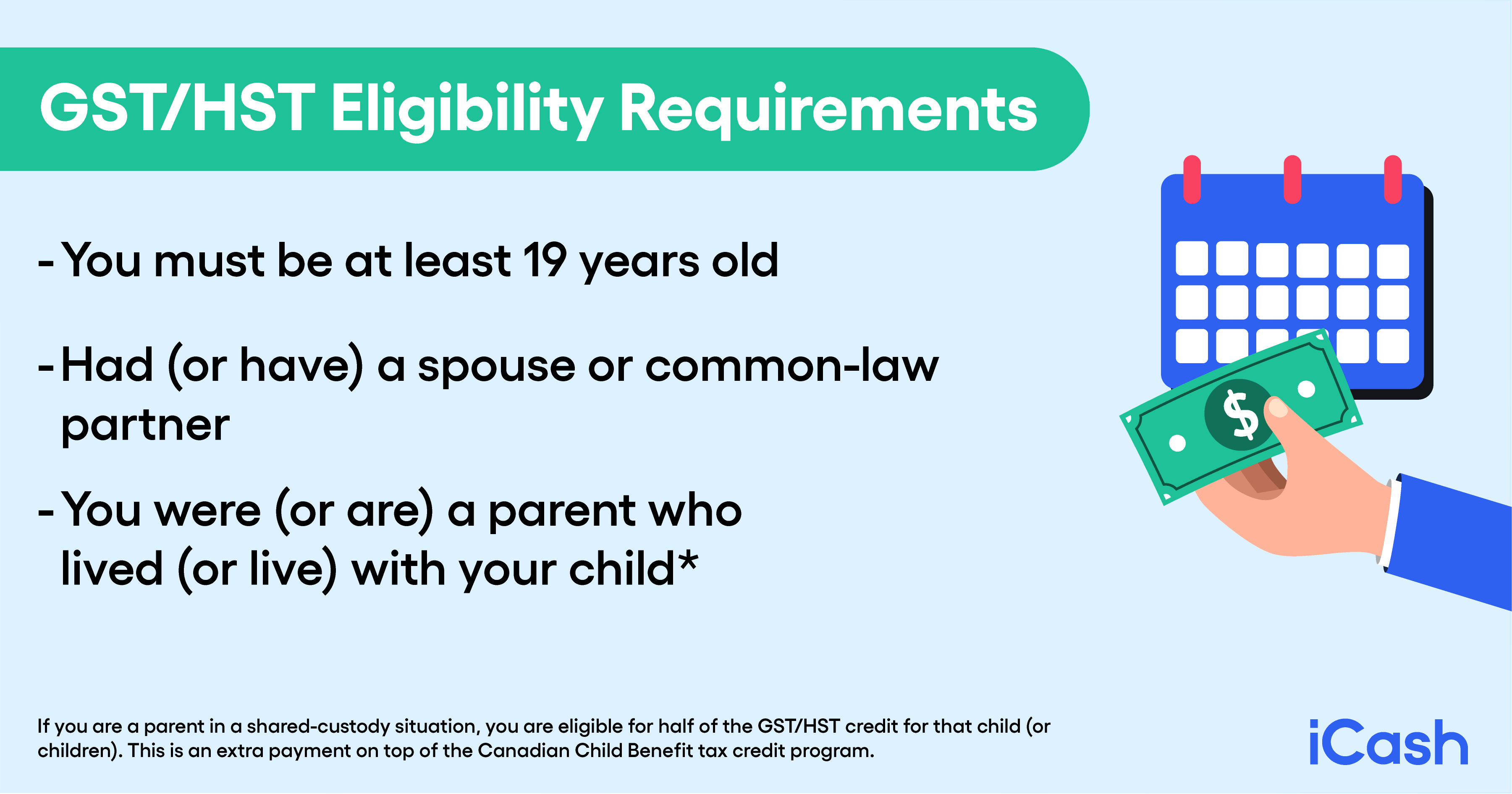

Who Is Eligible For The GST/HST Credit in 2024 & How Much Can You Get?

gst-hst-credit