If you have an net taxable income below Rs 5 lakh, then you are eligible for income tax rebate u/s 87A which will essentially make your tax liability nil. Nonetheless you should file ITR because every person whose income is above the basic exemption limit is mandated to do so.

Income Tax: Is it mandatory to file ITR even if your annual income is less than Rs 5 lakh/annum?

income tax: Post tax, Rs 5 lakh income will be higher than Rs 5.16 lakh: Here's why - The Economic Times

Earning below 5 lakhs? Do you still need to file ITR?

Selling a house? Watch out for tax implications - The Economic Times

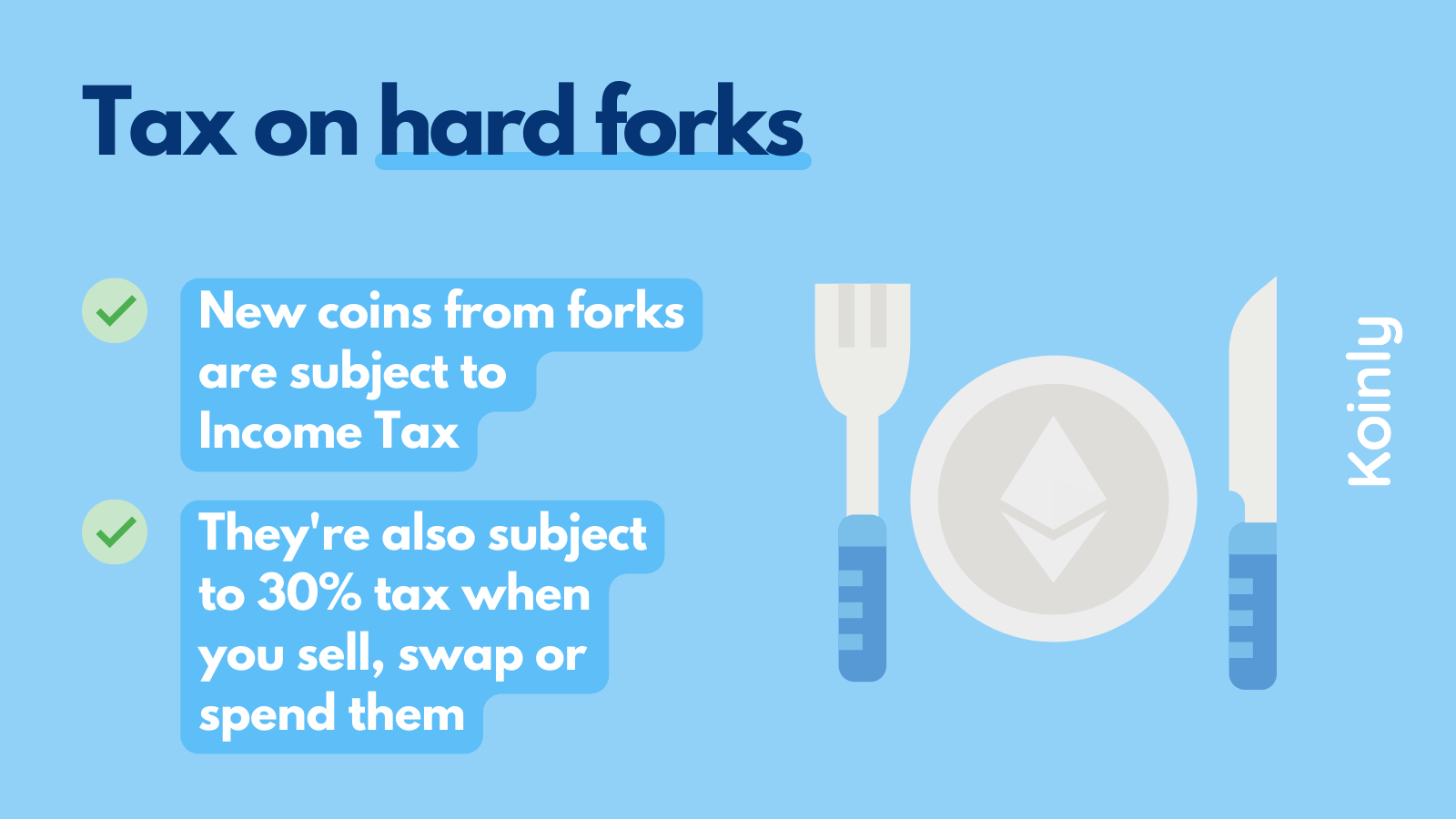

Crypto Taxes India: Expert Guide 2024, CPA Reviewed

Does your income fall below threshold? You might still need to file your income tax return

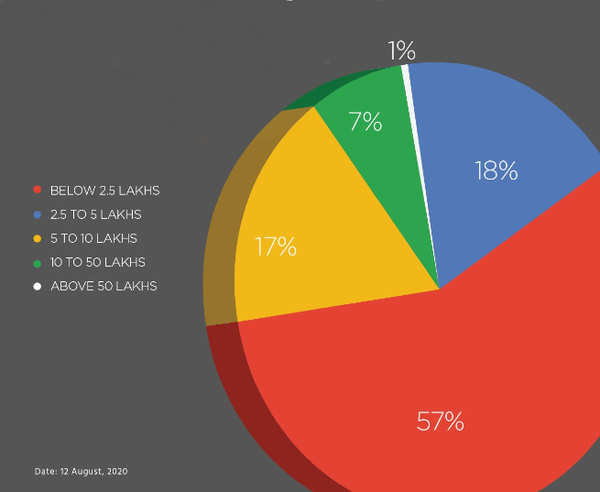

Income Tax Payers Data: People earning less than 2.5 lakh

If total income is more than 50 Lakh including salary, not eligible to file ITR in Form ITR-1

ITR Filing: Can I switch to the new tax regime when filing a belated income tax return?