:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

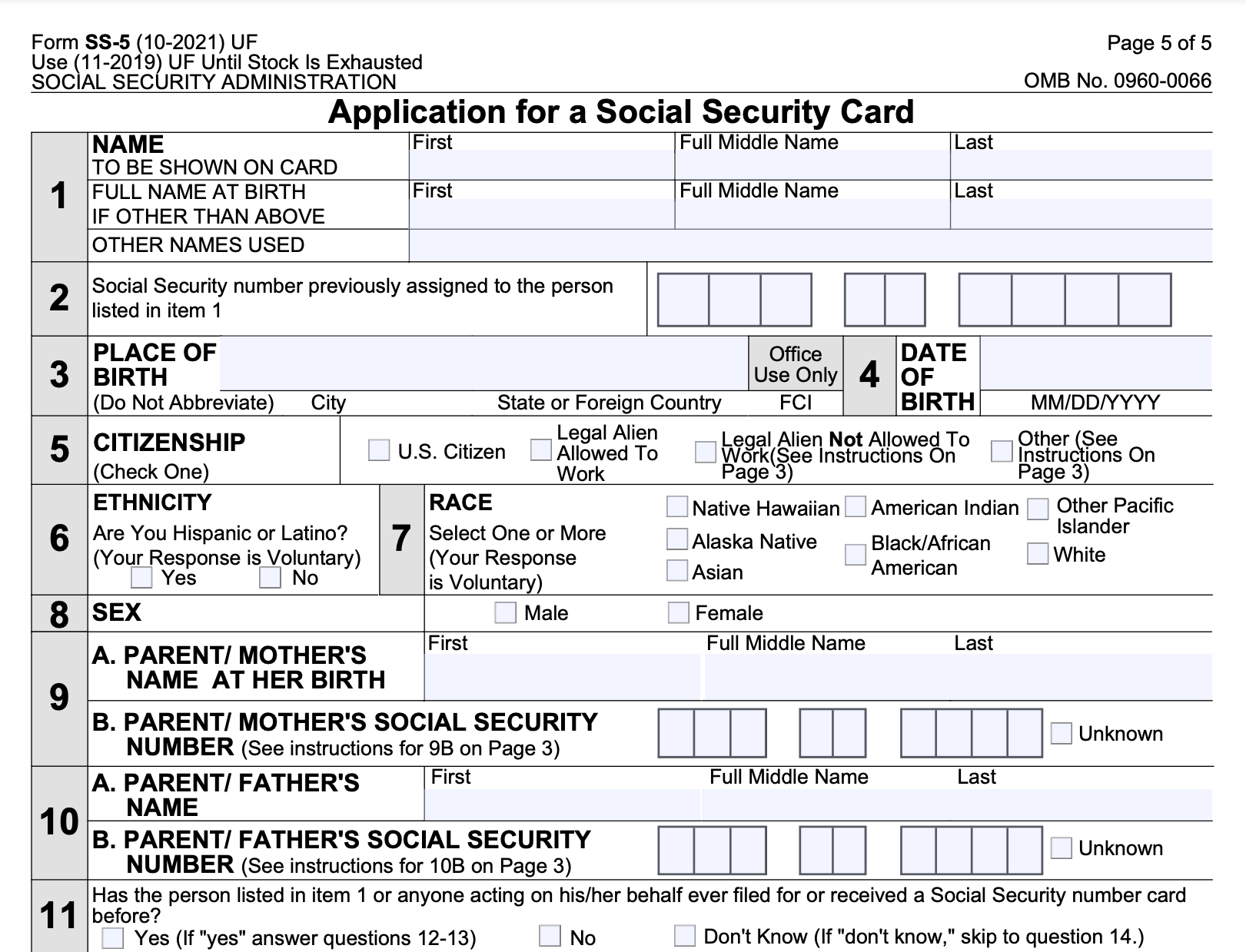

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

What is the FICA Tax and How Does it Connect to Social Security

Thaddeus Fonck (@ThaddeusFonck) / X

Requesting FICA Tax Refunds For W2 Employees With Multiple

UAE Corporate Tax Registration Exemptions – Tax, 46% OFF

:max_bytes(150000):strip_icc()/GettyImages-52123754-86268ce34a0c44b49b5421455fc5af5c.jpg)

Social Security Administration (SSA): What It Is and How It Works

Requesting FICA Tax Refunds For W2 Employees With Multiple

UAE Corporate Tax Registration Exemptions – Tax, 46% OFF

Overview of FICA Tax- Medicare & Social Security, fica tax

What Is Social Security Tax? Definition, Exemptions, and Example

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

:max_bytes(150000):strip_icc()/iStock_92129291_MEDIUM.social.security.bldg-e5e3b3bde3db445ab7edf3bb24fd255a.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

:max_bytes(150000):strip_icc()/GettyImages-1157031498-8ac74a299d2f4dc0b5eb0f401603be92.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

100e7 FM - A Rádio do Seu Coração, caiobá fm 100.7

FICA Tax Refund Timeline - About 6 Months with Employer Letter and