The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.

Difference Between Depreciation and Amortization - Shiksha Online

▷ Mantenimiento de Activos Fijos: ¿Cómo Funciona? ✓

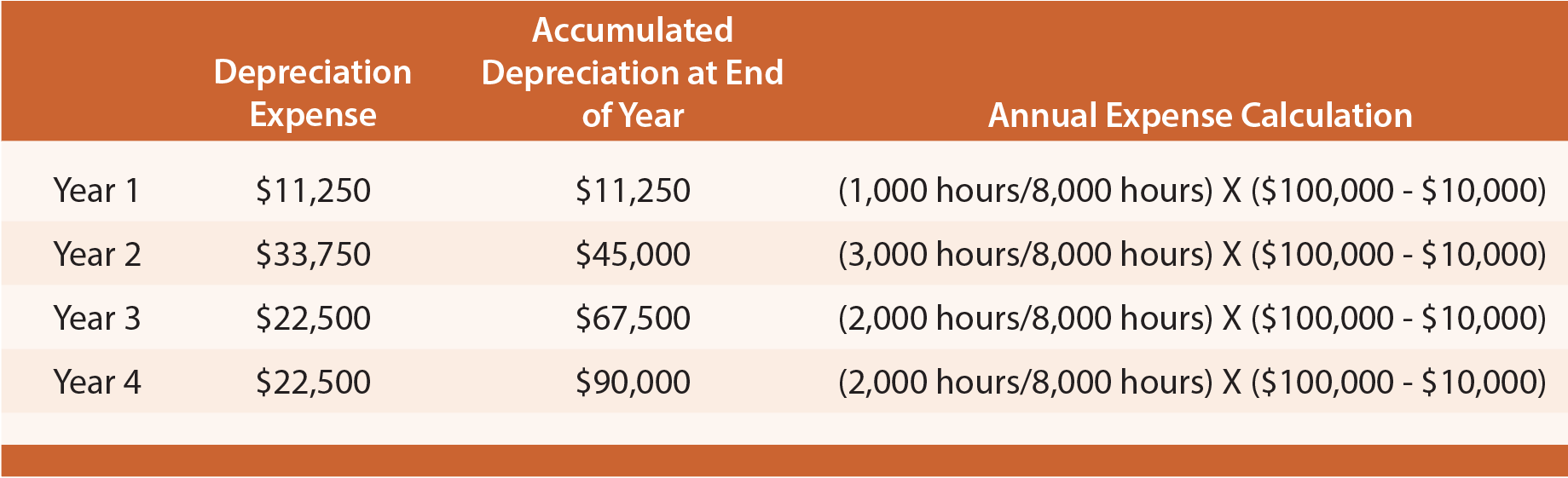

Depreciation Methods

Double Declining Balance Depreciation Method

Double Declining Balance Method (DDB)

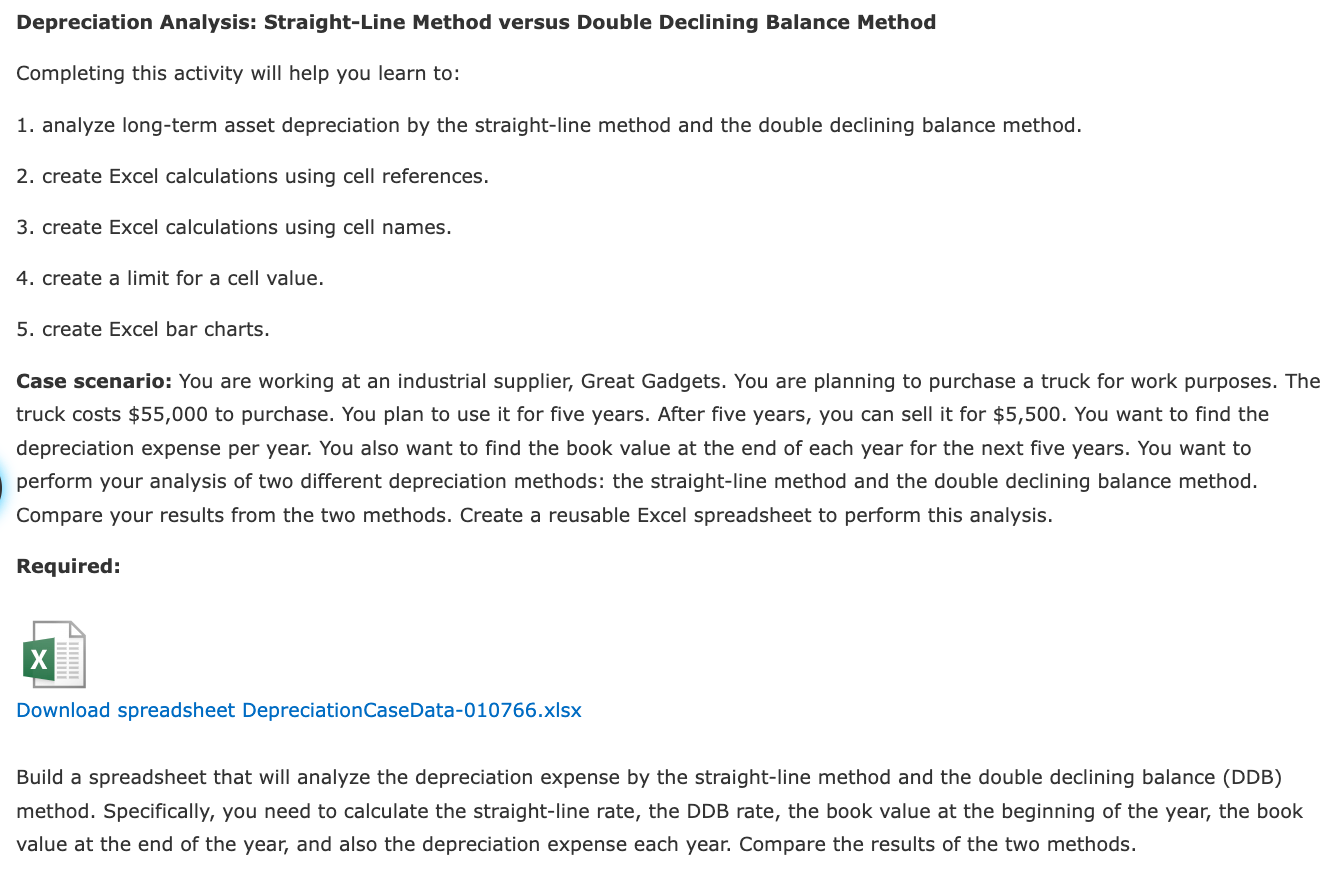

Solved Depreciation Analysis: Straight-Line Method versus

What is the purpose of the double declining balance method? Why is it 'double' as opposed to 'single' or 'triple'? - Quora

Depreciation - Meaning, Types, Calculation, And More - Glossary by Tickertape

Depreciation in Accounting - Meaning, Types & Examples

Straight Line Method Of Depreciation Example – Otosection

:max_bytes(150000):strip_icc()/Useful-life-Recirc-blue-d6507e2b75df4077b3f5e31d07f2344e.jpg)

Useful Life Definition and Use in Depreciation of Assets

Solved] PART 4: ANALYSIS OF DEPRECIATION METHODS No matter which type of

Depreciation recapture in the partnership context