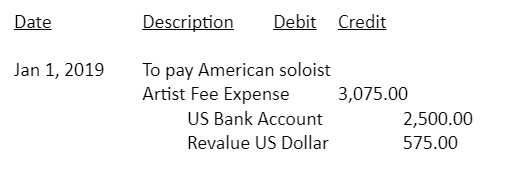

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

The Case Of The Securities And Exchange Commission Essay

:max_bytes(150000):strip_icc()/DDM_INV_accounting-records_final-4x3-31994fdd4ca34b9eba06ab533cb92b5f.jpg)

Accounting Records: Definition, What They Include, and Types

Foreign Currency Conversion Example

CPA Review: Excel Professional Services Inc, PDF

I only need help with B, D, and E. I will post the

CPA 2021 Annual Report and Performance Review by The

Property Management Accounting Basics: Definitive Guide

Assessment Questions - SAP S4HANA, PDF, Debits And Credits

How do I record a US$ or other foreign currency transaction

Property Management Accounting Basics: Definitive Guide

FINANCIAL ACCOUNTING FINAL EXAM

What types of journal entries are tested on the CPA exam